closed end loan disclosures

Section 332 - Disclosures. Home equity lines of credit reverse mortgages and mortgages secured by a mobile home or by a dwelling other than a cooperative unit that is not attached to real property ie.

Appendix G To Part 1026 Open End Model Forms And Clauses Consumer Financial Protection Bureau

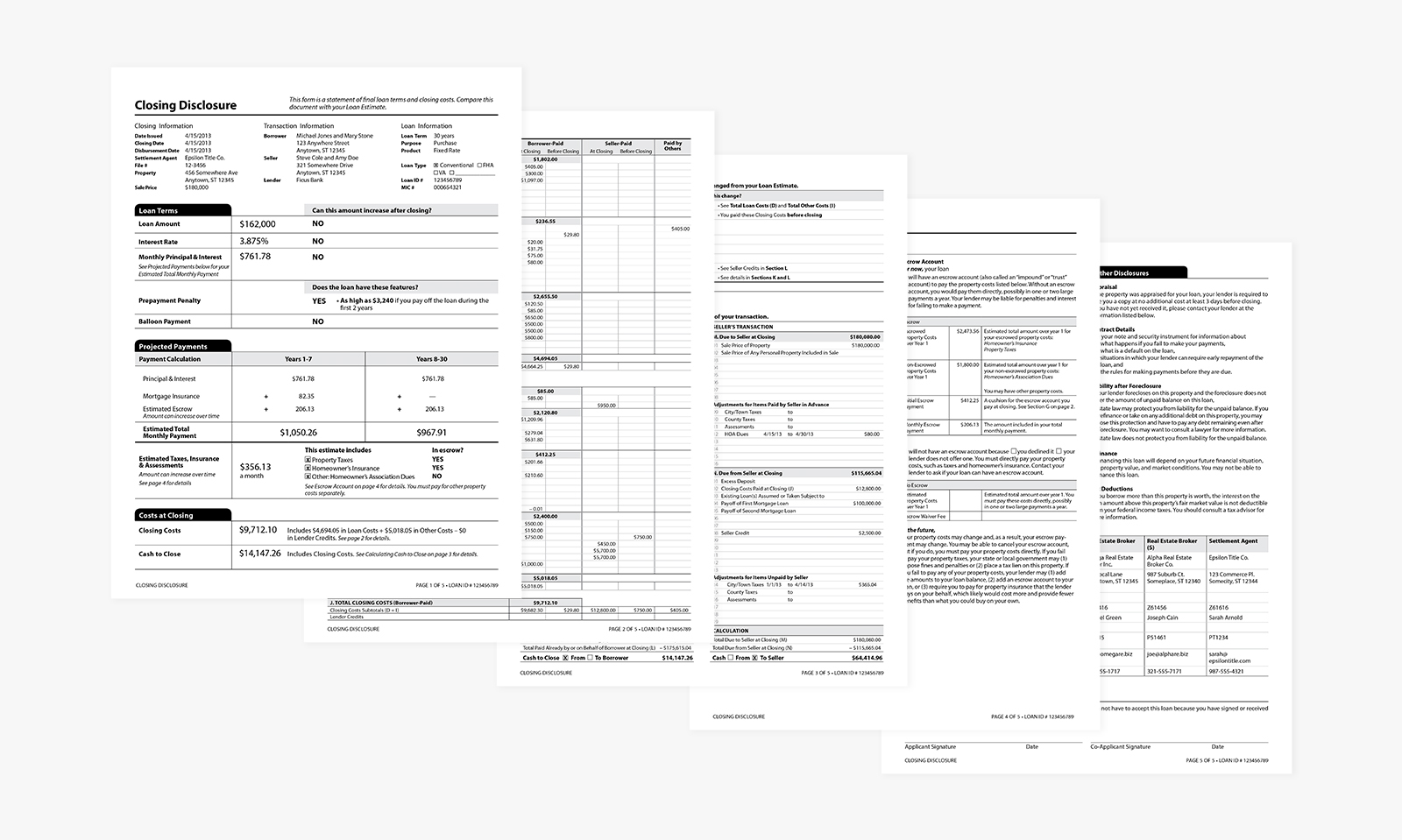

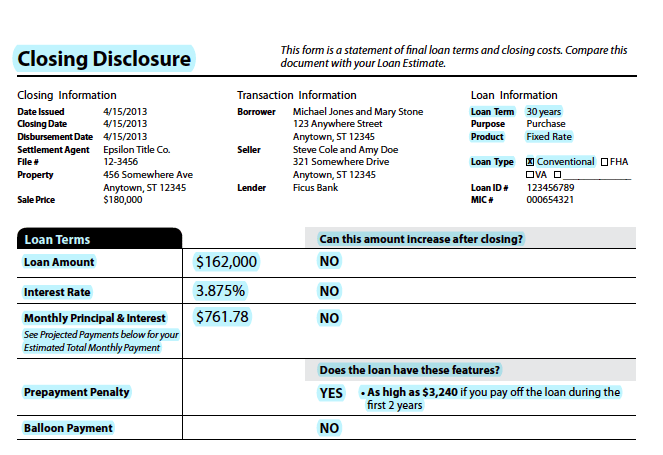

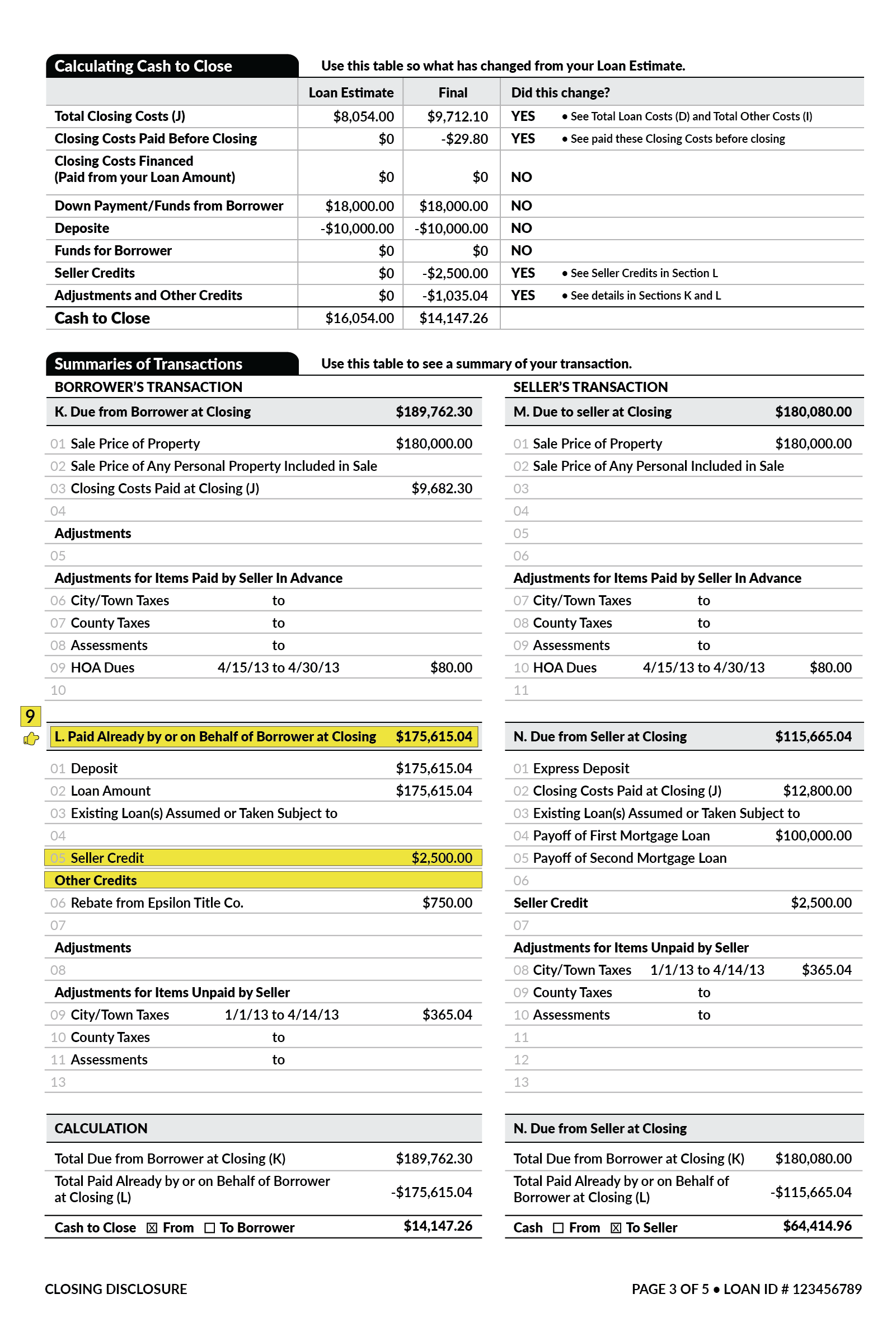

At least three business days before youre scheduled to close on your mortgage loan.

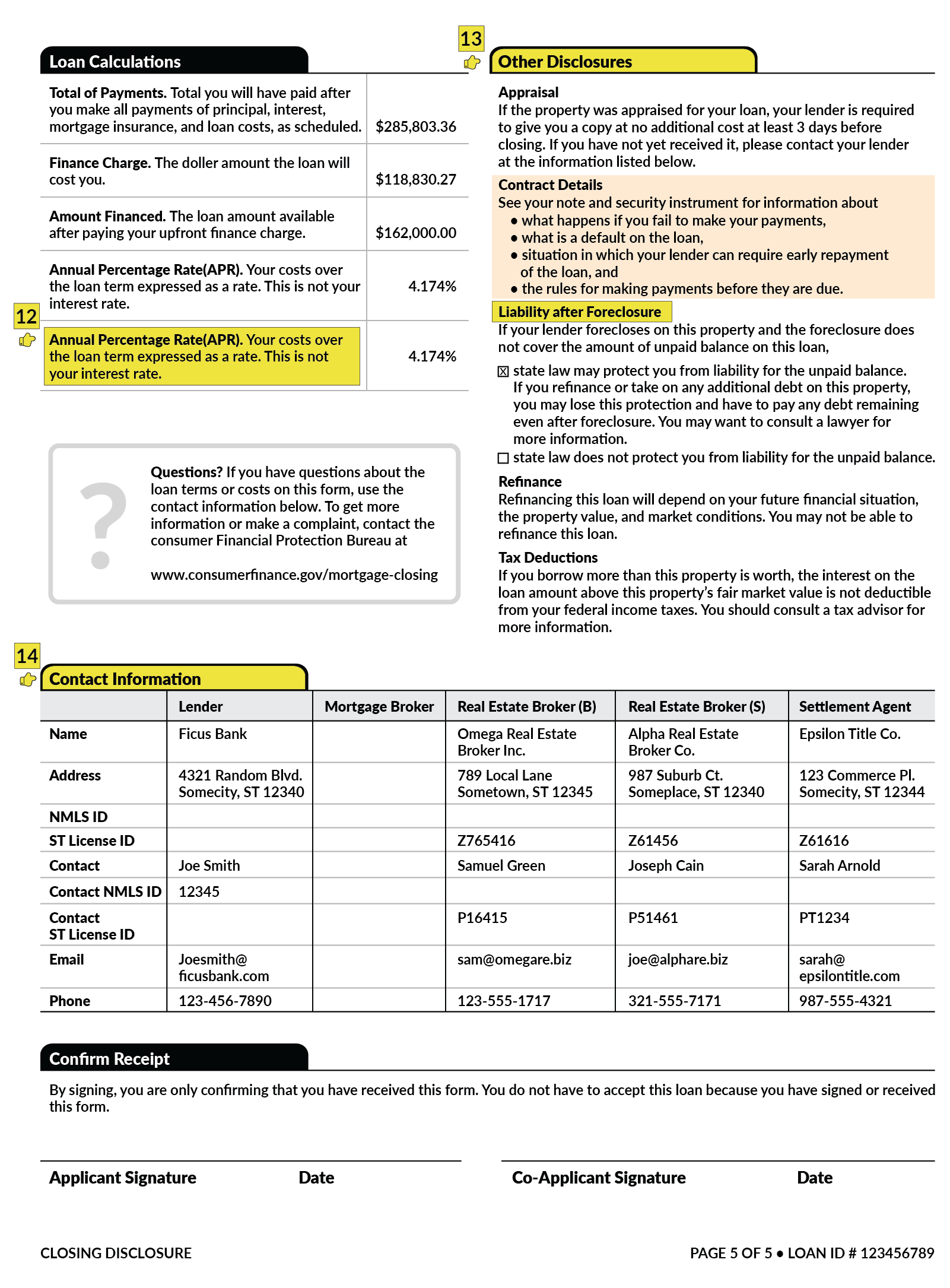

. Disclosure section of the Closed End Loan Disclosure Statement. Calculation of amount financed APR finance charge security interest charges. The Credit Union will provide closed-end disclosures that will include the following information.

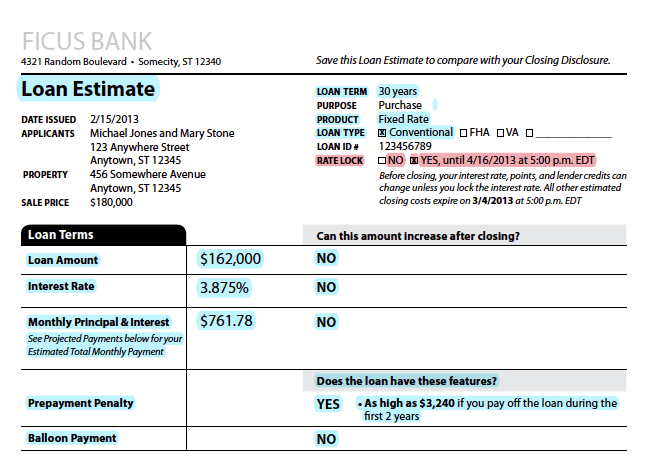

2 The number of payments or period of repayment. For closed-end credit transactions secured by real property Reg Z 102619 requires Credit Unions to provide members with good-faith estimates of credit costs and transaction terms on a document called the Loan Estimate. Requirements under the TILA-RESPA Integrated Disclosure rule TRID.

Creditors providing the disclosures required by 10269c2vB of this section in person in connection with financing the purchase of goods or services may at the creditors option disclose the annual percentage rate or fee that would apply after expiration of the period on a separate page or document from the temporary rate or fee and the length of the period provided that the. The Loan Estimate and Closing Disclosure must be used for most closed-end consumer mortgages secured by real property or a cooperative unit. Trigger terms when advertising a closed-end loan include.

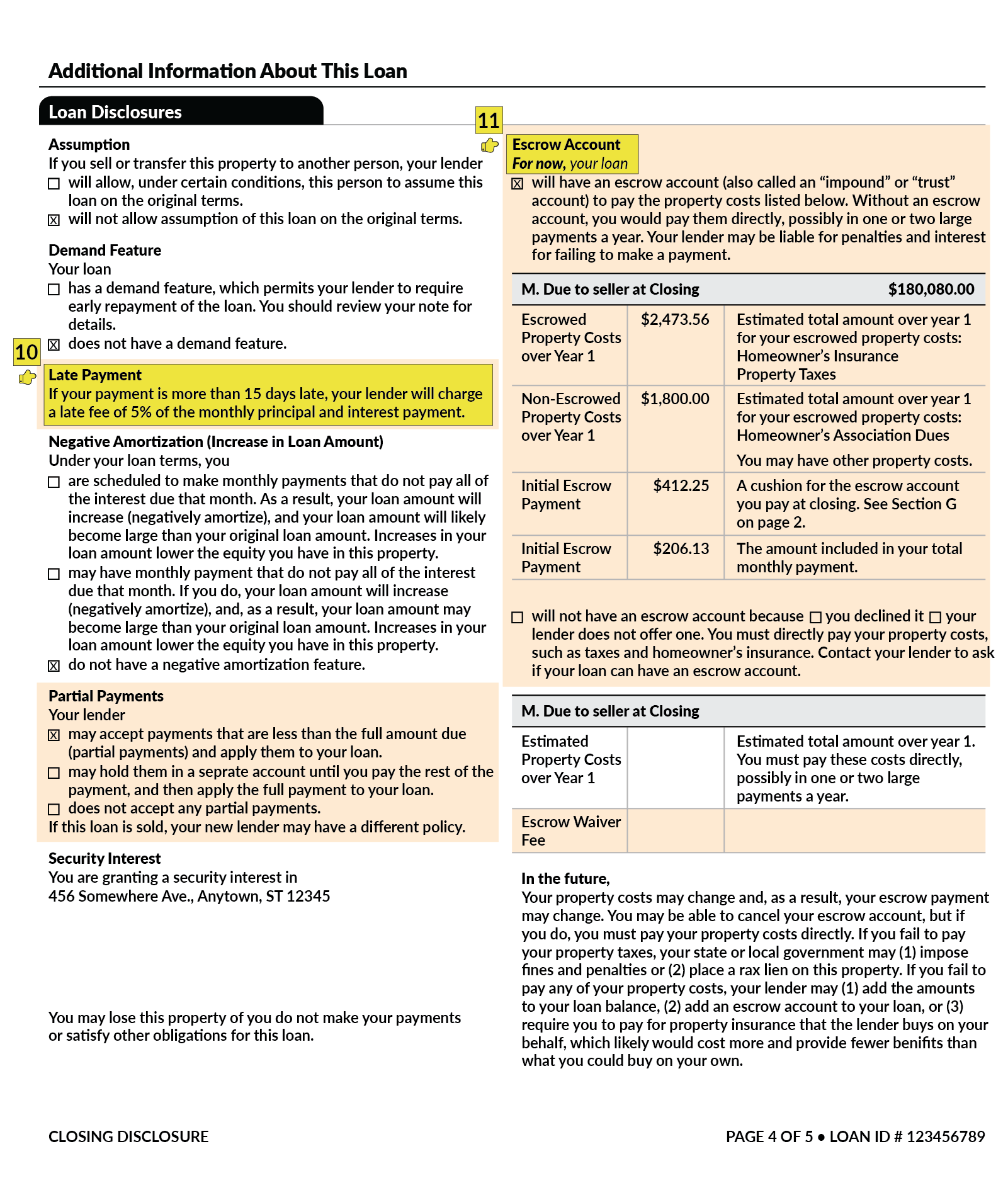

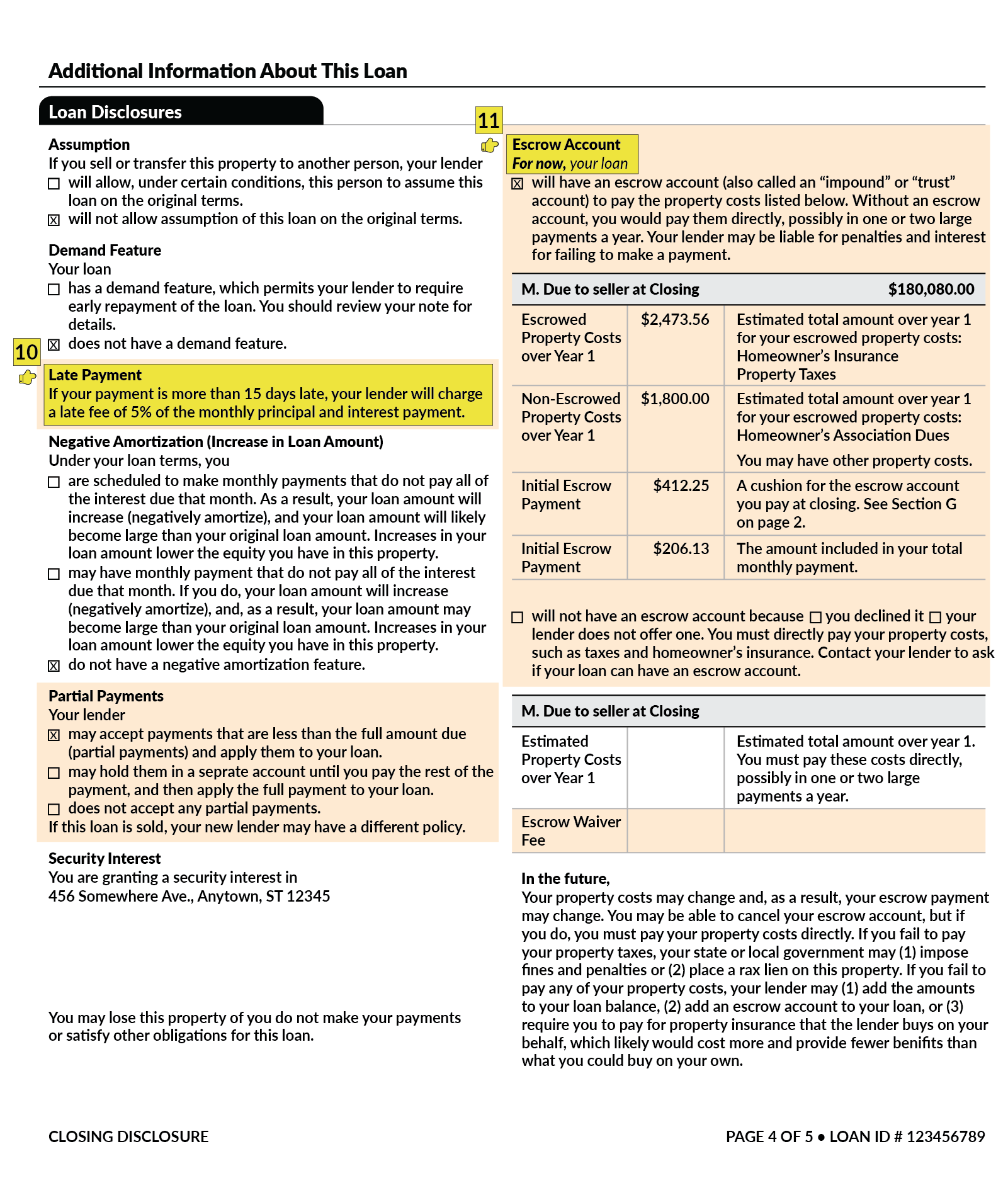

If this is a variable rate loan the Loan Amount section as set forth in the Closed End Loan Disclosure Statement tells you whether if the interest rate increases you will have to make more payments higher payments or if the final payment will be a balloon payment. The Loan Estimate is provided within three business days from application and the Closing Disclosure is provided to consumers three business days before loan consummation. The Loan Estimate is provided within three business days from application and the Closing Disclosure is provided to consumers three business days before loan consummation.

1 The amount or percentage of any downpayment. Stating No downpayment does not trigger additional disclosures. If a closed-end consumer credit transaction is secured by real property or a cooperative unit and is not a reverse mortgage the creditor discloses a projected payments table in accordance with 102637c and 102638c as required by 102619e and f.

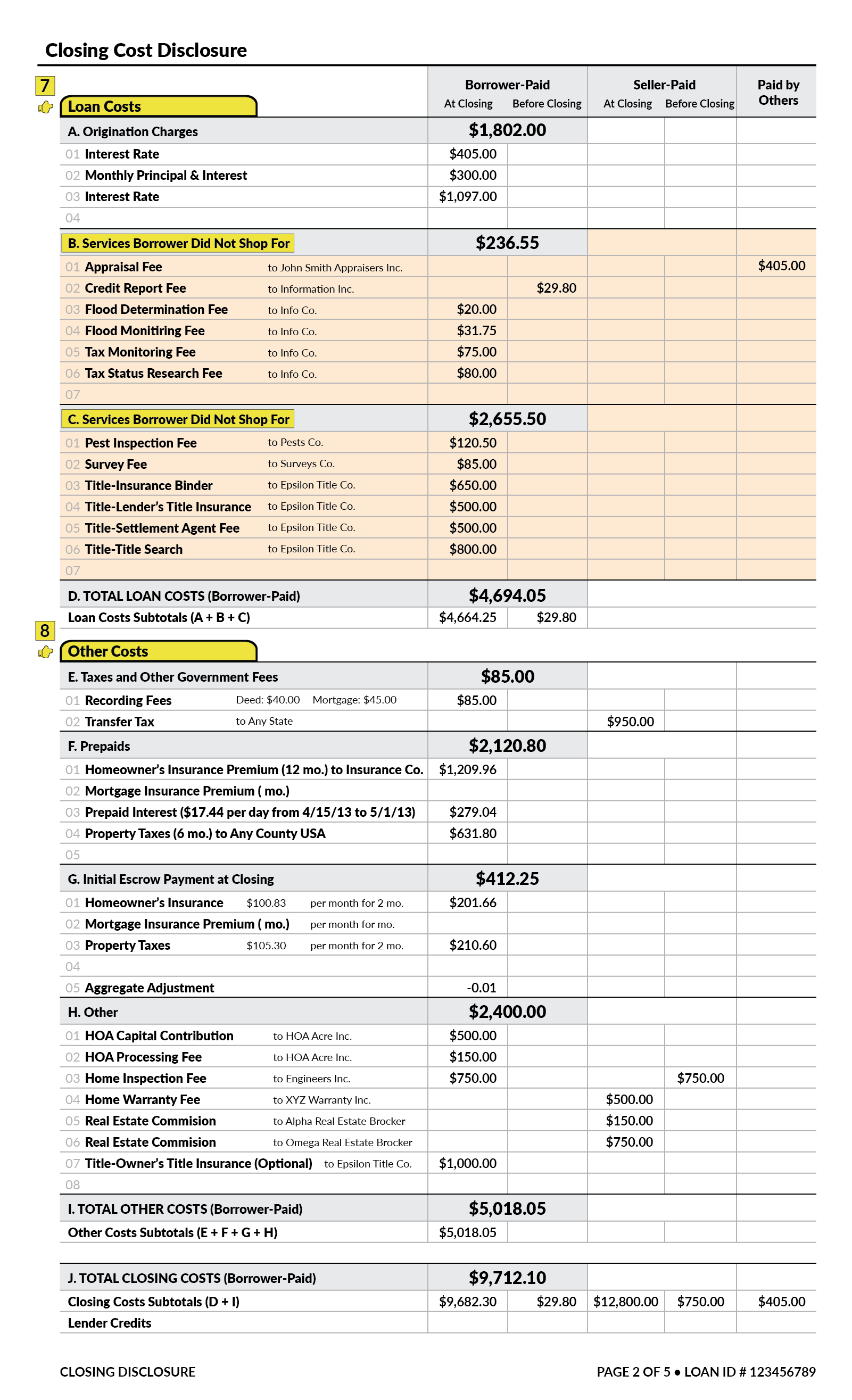

3 The amount of any payment. 22619a1 and 22619a2 10. Thus for most closed-end mortgages including construction-only loans and loans secured by vacant land or by 25 or more acres not covered by RESPA the credit union must provide the Loan Estimate and the Closing Disclosure.

Why is it important. Payment schedule including number amount and timing of payments. It provides you with the actual costs of the mortgage loan youve selected including.

The regulation was also revised to reflect the 1995 Truth in Lending amendments that dealt primarily with tolerances for loans secured by real estate and limitations on lenders liability for disclosure errors for these types of loans. Sample List of Closed-End Residential Mortgage Disclosures Required to be Given to Consumers at Loan Application by Maryland Mortgage Lenders and Brokers. Loan amount Interest rate.

Format of Regulation Z. Most closed-end consumer mortgage loans. Requires certain disclosures be made to the member before consummation of a closed-end home equity loan.

A Closing Disclosure is a five-page form providing final details about the mortgage loan youve selected. Part 33 - Variable Rate Closed-end Personal Loans. Mortgages and Initial Disclosure Rules.

These disclosures must be used for mortgage loans for which the creditor or mortgage broker receives an application on or after August 1 2015. Thus for most closed-end mortgages including construction-only loans and loans. When will you receive it.

Description of the security interest if applicable. Or 4 The amount of any finance charge. Corwin Esquire Gordon Feinblatt LLC 233 East Redwood Street Baltimore Maryland 21202 Telephone 410-576-4041 Facsimile 410-576-4196 E-mail.

For closed end dwelling-secured loans subject to RESPA does it appear early disclosures are delivered or mailed within three 3 business days after receiving the consumers written application and at least seven 7 business days before consummation. For closed end dwelling-secured loans subject to. These disclosures must be used for mortgage loans for which the creditor or mortgage broker.

In a closed-end consumer credit transaction secured by a first lien on real property or a dwelling other than a reverse mortgage subject to 102633 for which an escrow account was established in connection with the transaction and will be cancelled the creditor or servicer shall disclose the information specified in paragraph e2 of this section in accordance with the form. Prepared by Marjorie A. Closed-end consumer credit transactions secured by real property or a cooperative unit other than a reverse mortgage subject to 102633 opens new window are subject to the disclosure timing and other requirements under the TILA-RESPA Integrated Disclosure rule TRID.

The Loan Estimate must. Higher-cost closed-end mortgage loans and included new disclosure requirements for reverse mortgage transactions. The circumstances under which the rate for the loan may vary including disclosures of the intervals at which the lending institution may change the rate on the loan the times.

When you apply for a mortgage loan the lender is required to provide you with initial loan disclosures within three days of application.

A Guide To Understanding Your Closing Disclosure Blumberg Blog

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

How To Read A Mortgage Loan Estimate Nextadvisor With Time

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

What To Know About The Loan Estimate Closing Disclosure Cd

What Is A Closing Disclosure Lendingtree

How To Comply With The Closing Disclosure S Three Day Rule Alta Blog

What Is A Closing Disclosure Lendingtree

What To Know About The Loan Estimate Closing Disclosure Cd

What Is A Closing Disclosure Lendingtree

What Is A Closing Disclosure Lendingtree

Apr Calculator Truth In Lending Act Disclosure Statements

What Is A Closing Disclosure Lendingtree

Understanding Finance Charges For Closed End Credit

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Fdic Fdic Consumer News Fall 2015 Sample Disclosures Consumer Financial Protection Bureau